how long does it take the irs to collect back taxes

This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date they were. Ad Fill out form to find out your options for FREE.

Tax Filing Season Kicks Off Here S How To Get A Faster Refund

100 Money Back Guarantee.

. If you have received notice. One of the first things people often wonder when they incur a tax liability is how long the IRS has to collect it. The vast majority of tax refunds are issued by the IRS in less than 21 days according to the IRS.

End Your IRS Tax Problems - Free Consult. The time period called statute of limitations within which the IRS can collect a tax debt is generally 10 years from the date the tax was officially assessed. Get A Tax Analysis Consultation.

End Your IRS Tax Problems - Free Consult. Ad BBB Accredited A Rating. Remember you can file back taxes with the IRS at any time but if you want to claim.

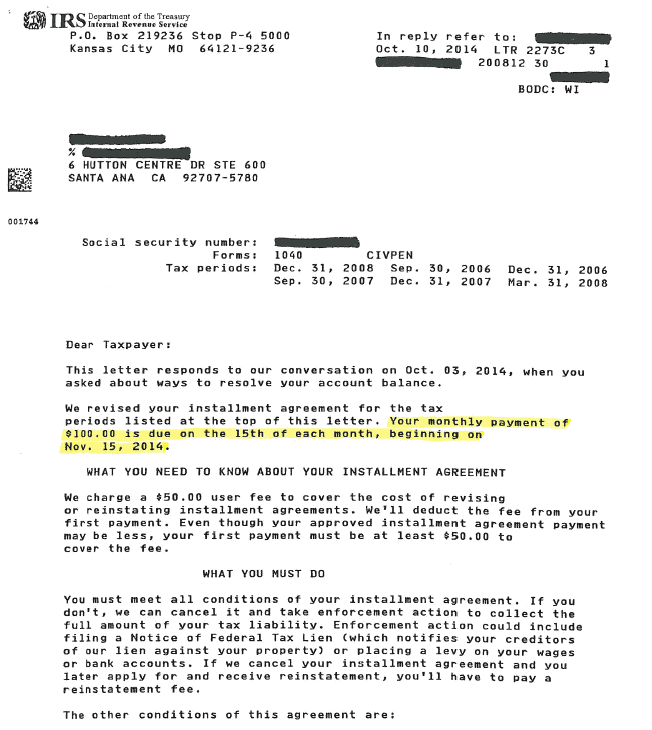

Once a lien arises the IRS generally cant release the lien until the tax penalty interest and recording fees are paid in full or until the IRS may no longer legally collect the tax. Owe IRS 10K-110K Back Taxes Check Eligibility. As a general rule there is a ten year statute of limitations on IRS collections.

Ad File Settle Back Taxes. OICs must be finalized within 2 years after the IRS receives the OIC application Form 656 with required information and payments. It takes about six weeks for the IRS to process accurately completed back tax returns.

Trusted A BBB Member. Tax bills of more than 50000 take 7-12 months. What does this mean.

For most cases the. Whether the IRS is going to haunt them for the rest. Unfiled Tax Return Help.

Ad Help With Back Taxes. Take Advantage of Fresh Start Program. Most taxpayers who file electronically and choose direct deposit will get their refund within 21 days assuming there are no problems with the return according to the IRS.

There is an IRS statute of limitations on collecting taxes. January 31 2020. Possibly Settle Taxes up to 95 Less.

You cant calculate how far back the IRS can collect taxes without knowing when the countdown clock starts. Up to 30 days in advance and receive instant confirmation that you submitted your payment Debit or credit card You can pay your taxes by debit or credit card. The IRS 10 year statute of limitations starts on the day that your.

You will have 90 days to file your past due tax return or file a petition in Tax Court. Ad BBB Accredited A Rating. If you do neither we will proceed with our proposed assessment.

By law the IRS only has ten years to collect the unpaid taxes from the time of the initial tax assessment. As usual if you overpaid your taxes in 2021 youll receive that money back. We can Help Suspend Collections Wage Garnishments Liens Levies and more.

Both paper and electronic filers. 12 Years In Business. Ad Resolve Your IRS Tax Problems.

See if you Qualify for IRS Fresh Start Request Online. Ad Owe back tax 10K-200K. Get Your Qualification Options for Free.

The College Investor offers a long list of IRS refund reference codes and errors. This 10-year period is called the statute of. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection.

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Irs Tax Refund Delays Persist For Months For Some Americans Abc13 Houston

Can The Irs Collect After 10 Years Fortress Tax Relief

Faqs On Tax Returns And The Coronavirus

Irs Tax Letters Explained Landmark Tax Group

Tax Consolidation Irs Debt Relief Help From Licensed Professionals

How Do I Know If I Owe The Irs Debt Om

I Owe The Irs Back Taxes Help J M Sells Law Ltd

Tax Refund 2021 Tips On How To Avoid Delays As Pandemic Continues To Impact Irs Abc7 Chicago

Irs Tax Refund Status Illinois Residents Still Waiting For Federal Tax Refunds 9 Months After Filing Abc7 Chicago

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

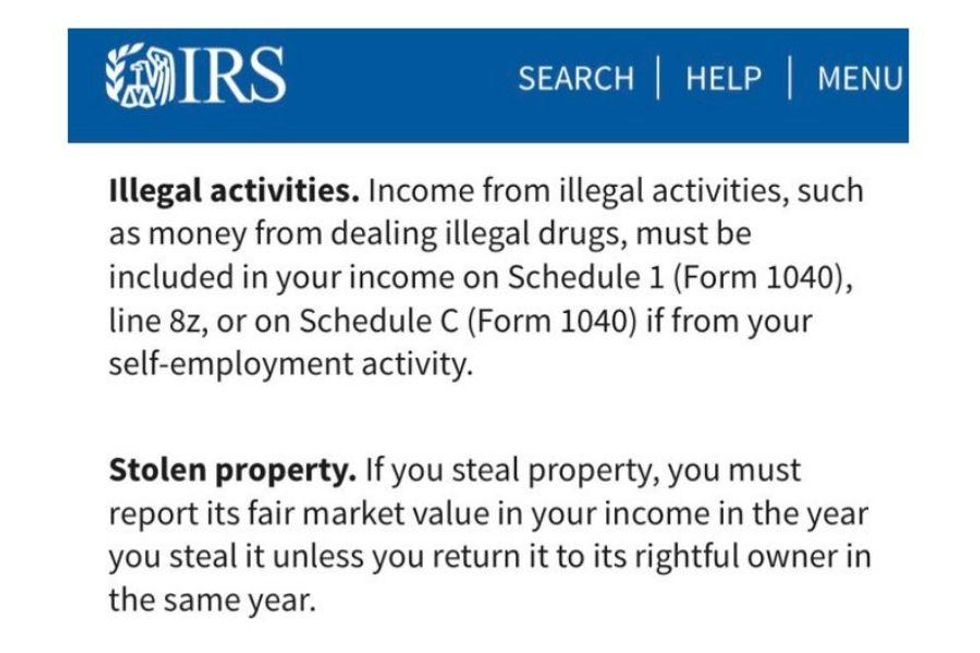

The Irs Says Criminals Have To Report Illegal Income Seriously Upworthy

Irs Refunds When Is The Irs Accepting 2022 Tax Returns Marca

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Tax Debt Relief Forgiveness On Taxes

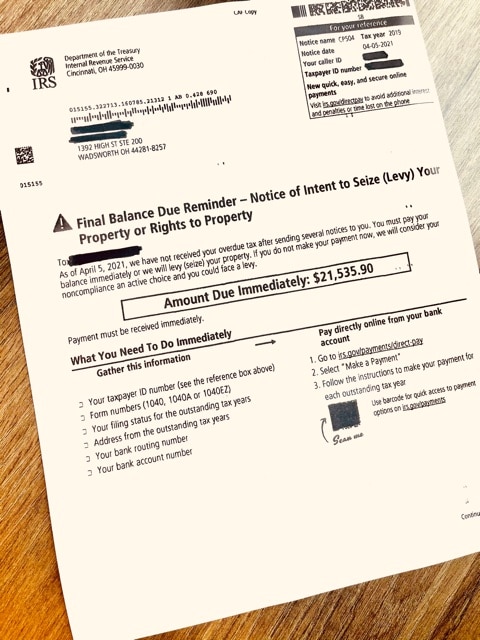

Know What To Expect During The Irs Collections Process Debt Com

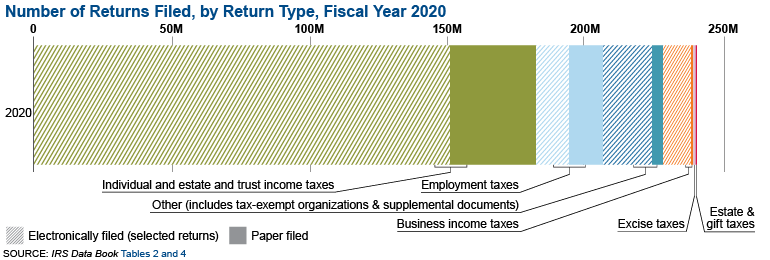

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor